3M (MMM) to Divest Neoplast & Neobun Brands to Selic Corp

3M Company MMM recently entered into an agreement to sell its Neoplast and Neobun brands, along with related assets in Thailand and some other Southeast Asian countries, to Selic Corp Public Company Limited as part of its strategic portfolio management. 3M will also divest the manufacturing assets of its Ladlumkaew, Thailand, facility to Selic Corp.

Neoplast and Neobun brands are part of 3M’s Consumer Health & Safety Division (“CHSD”), including sports and medical tapes, bandages and medicated products for the consumer and healthcare industry. These brands, which make skin health and wellness products, are sold primarily in Thailand and Southeast Asia.

By exiting these businesses, 3M intends to focus on its core areas within the CHSD.

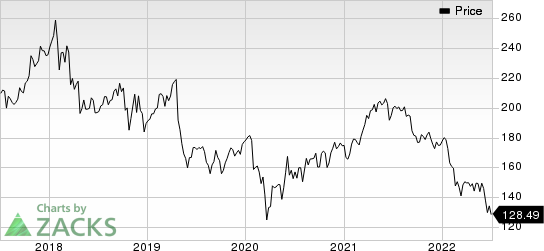

3M Company Price

3M Company price | 3M Company Quote

As previously announced, 3M will shut down its Ladlumkaew plant by August end. This will affect around 250 employees in Thailand. Those impacted will be eligible for severance and outplacement assistance.

The divestiture of the Neoplast and Neobun brands is expected to be completed in the fourth quarter of 2022, and is not likely to have a material impact on 3M's financial results.

3M has lately been focused on restructuring its portfolio to enhance shareholder value. In fourth-quarter 2021, the company inked a deal to divest its food safety business. In March 2022, it sold its floor care products business. The successive divestments are expected to help MMM focus on its core business areas and drive growth.

Zacks Rank & Key Picks

3M carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Diversified Operations industry are as follows:

Carlisle Companies CSL sports a Zacks Rank #1 (Strong Buy). CSL has a stellar earnings surprise history, having outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 23%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carlisle has an estimated earnings growth rate of 86.9% for the current year. The Zacks Consensus Estimate for the company’s current-year earnings has been revised upward by 10.7% in the past 60 days. Shares of CSL have gained nearly 26% in a year.

Griffon Corporation GFF flaunts a Zacks Rank #1. GFF’s earnings have surpassed the Zacks Consensus Estimate in three of the preceding four quarterswhile missing in one. The average surprise was 97%.

Griffon has an estimated earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for the company’s current-year earnings has been revised upward by 28.9% in the past 60 days. Shares of GFF have gained around 13% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance