7 banks cut savings rates: Here’s where to stash your cash

Seven banks have now moved to cut savings rates amid speculation that the Reserve Bank will cut rates even lower.

NAB has been the latest to slash rates, following ING, the Bank of Queensland, Credit Union SA, Beyond Bank, Bank First and Arab Bank Australia.

It brings savings rates to some of the lowest levels Australians have ever seen.

“When it comes to savings interest rates, prices are down. Today NAB sliced 0.10 per cent from savers’ rates, joining six others that have made similar moves in the last week,” Canstar financial services executive Steve Mickenbecker said.

“Term deposits provide no respite, also cut by between 0.05 per cent and 0.15 per cent.”

Aussies will have to be proactive in chasing higher rates, he added.

“Savers have to micromanage their money by qualifying for bonus rates or switching savings accounts every few months to earn introductory rates, or settle for rates around 0.05 per cent.

“Active management is now a savings necessity,” Mickenbecker told Yahoo Finance.

And rates don’t seem likely to perk back up for a very long time, he added.

“Banks are under less pressure to raise funds from savers and we have seen savings interest rates continue to slide through the pandemic. Perhaps an unanticipated consequence of the measure to fund business through the crisis.”

Where can I find a good deal?

Just because savings rates are low across the board doesn’t mean there is nothing you can do about it.

Two months ago, Westpac introduced a savings interest rate of 3 per cent for Aussies between 18 and 29 years old.

To be eligible for the Westpac Life rate, young savers just have to ensure their balance grows every month and they make five or more transactions on a linked transaction account.

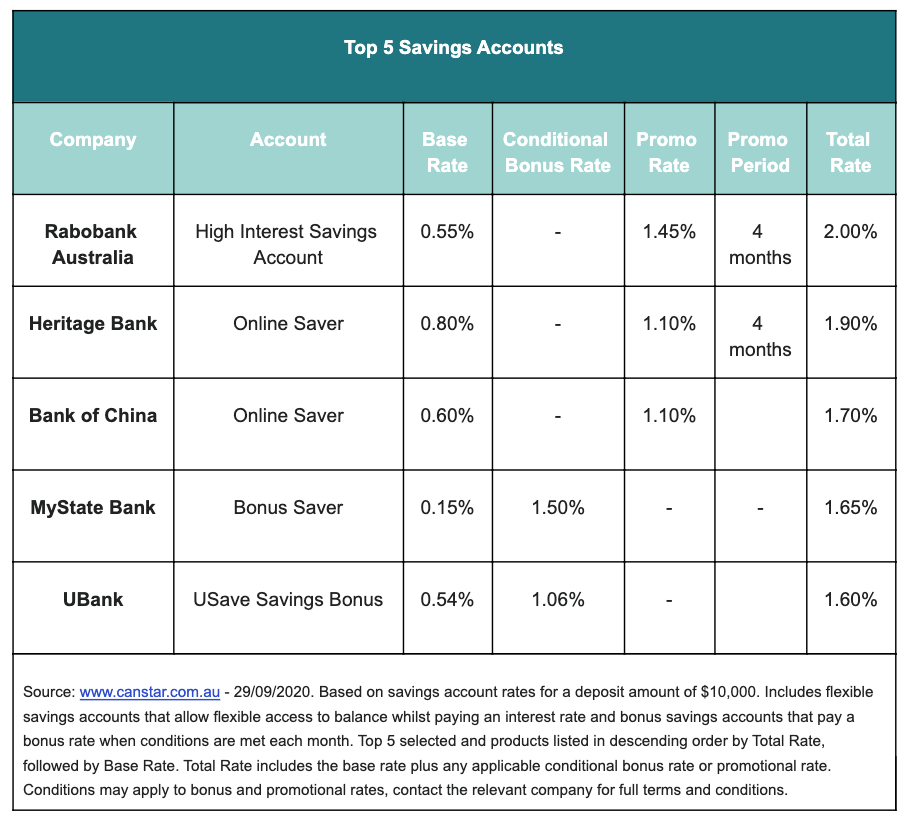

But if you’re not eligible for that savings account, Canstar has whittled down the best deals you can find on the market right now:

“Aside from Westpac's rate of 3% for 18 to 29 year olds, the top savings interest rate amongst the big four banks is a skinny 0.9 per cent. Australians have to cast the net wider than the brands they always know if they are going to find rates up to 2 per cent,” Mickenbecker said.

“With most accounts available online these days the leg work can be done in front of your screen.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance