How much do you really need in super to retire?

Australians looking to enjoy a comfortable retirement have been told they need $640,000 in superannuation as a couple or $545,000 as a single, but experts have said there’s more to the story than just the one figure.

Also read: The Aussies $115,000 worse off in retirement

Also read: ‘Grossly unfair’: How Australia’s super system penalises mothers

Speaking on the Yahoo Finance Women’s Money Movement webinar on Tuesday, senior financial adviser at Wealthwise Dawn Thomas said those figures are designed to give people a rough sense of how much they’d need, but that individual budgets and expectations need to come into the equation too.

“It's important for you to understand how much you need to live off and that relates back to how much capital you need to generate,” Thomas said.

“Most people don't realise that their home is their biggest asset and so they can use that down the track to downsize to use for income needs as well.”

She added that those sums, from the Association of Superannuation Funds of Australia (ASFA), are based on an expectation that those retirees will receive a part Age Pension.

ASFA’s modest retirement standard is significantly lower at $35,000 in super for a couple and $50,000 for a single person. That’s because it’s assumed that they will receive a significant pension.

What goes into a comfortable retirement?

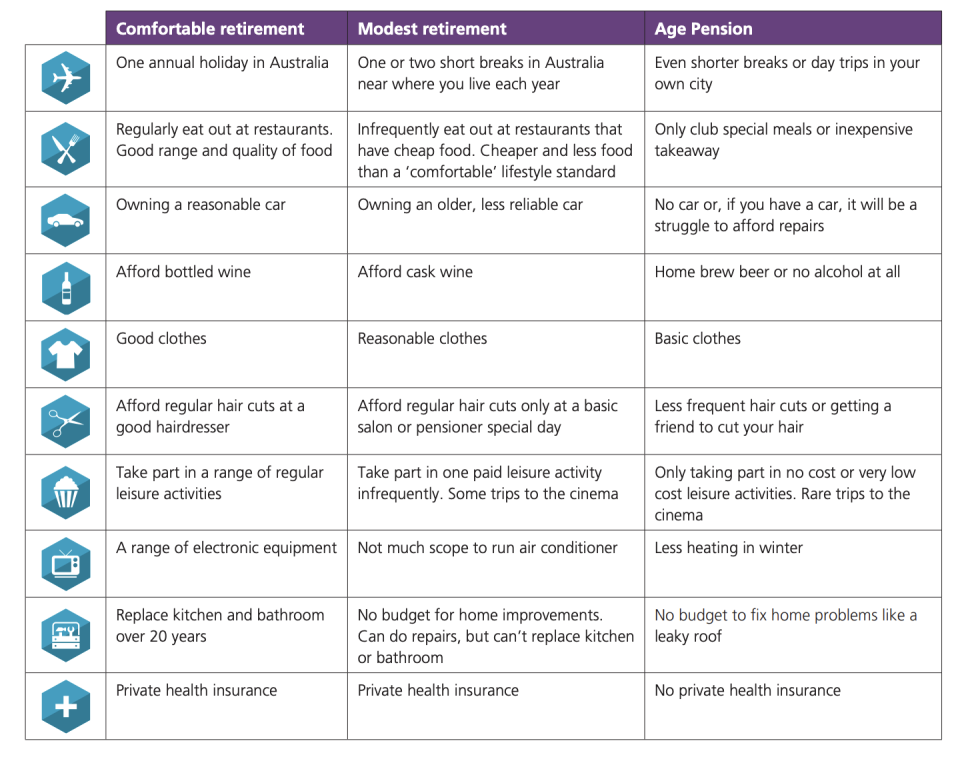

A ‘comfortable’ retirement is one that includes one international holiday a year, good clothes, bottled wine, private health insurance and a reasonable budget for home improvements, as defined by ASFA.

Conversely, someone having a ‘modest’ retirement is looking at one or two short breaks near where they live, cask wine and no budget for home improvements beyond repairs.

Both budgets assume the retiree is healthy and owns their home.

Here’s how that breaks down:

What if I don’t think I have enough?

Thomas said Australians approaching retirement who fear they don’t have enough need to talk to someone who understands their concerns.

The next step is to consider the question: “If you want to go down this path, what’s the consequence?”

That means, if you’ve worked out you want to have $500,000 in super but only have $300,000, what steps will you either take to work longer, earn more or adjust your goals?

“It’s about understanding the choices you have and being able to assess, ‘Okay, this is the path I want to go down but I understand what I’m giving up by going down this path,’” said Thomas.

Women with Cents founder and author of Wonder Woman's Guide to Money Natasha Janssens agreed, telling all savers to “run your own race”.

She said those ASFA figures are good at giving savers something to aim for, but aren’t the whole picture.

“Never give up, there’s always options. It’s great that you’ve noticed you’re approaching retirement and you’re starting to think about that. Now we want to sit down and get into action mode, because there are so many strategies that are available to help you play catch up quicker than you might have thought.”

That includes the option to downsize your home and put that profit into your super. Also consider the role of Centrelink and concessional contributions in your plan.

“Sit down with someone who knows these numbers … inside and out, and who can say to you, ‘Okay, this is how you want to structure your finances so you’re making the most of what’s available to you.’ There’s always going to be options.”

She said Australians should consider Transition to Retirement Income Streams, which are products allowing savers to begin to tap into their super while still working.

And be careful of any schemes or products that seem too good to be true, she added, warning that decisions that come from panic or fear can land you in hot water.

“That's where there's predators out there that can lure you in with ‘get rich quick’ schemes and all that sort of stuff that can really hurt you, so just want to think about what's important to you, and there's certainly strategies there that can help you get to that.”

Want to take control of your finances and your future? Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.