11 million Aussies to get up to $2.7k tax back: Why some will need to wait

Around 11.6 million Australians will receive some form of tax cut under the $17.8 billion personal tax cuts announced in Tuesday’s 2020 Federal Budget.

As widely anticipated, income tax cuts originally scheduled for July 2022 will be brought forward with immediate effect.

This is part of the Government’s three-stage flattening of the tax system, which it announced in the 2019 Budget. The first stage saw average income earners receive tax offsets of up to $1,080 in the 2019 financial year.

The second stage, originally scheduled for July 2022, sees the 19 per cent threshold jump from $41,000 to $45,000 and the 32.5 per cent threshold climb from $90,000 to $120,000.

This stage is being backdated to 1 July 2020 and now comes with an extension to the low- and middle-income tax offset.

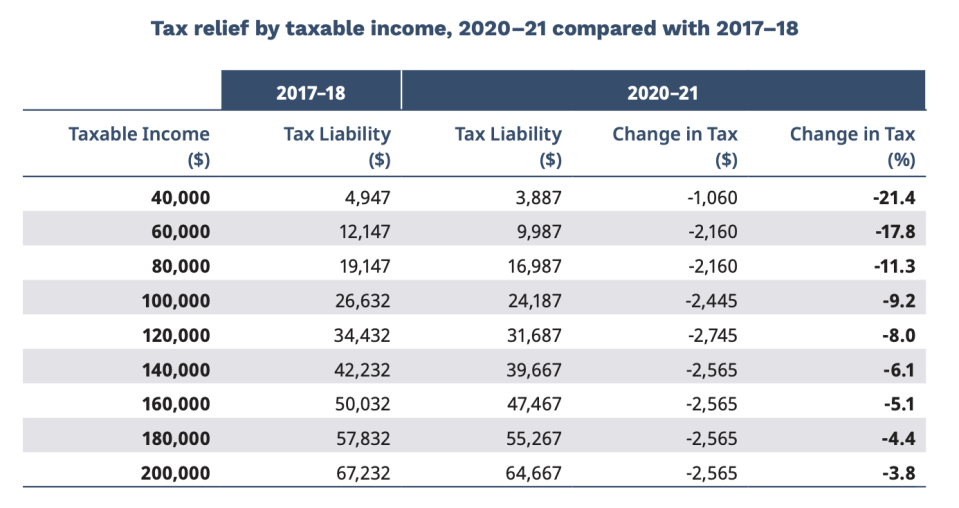

That means those earning $120,000 or more will get $2,745 back, those taking home $80,000 will get $2,160 back and those making $40,000 will get $1,060 back.

However, the low- and middle-income tax cut will only be extended for one year, meaning those workers will pay more tax next year.

Under the third stage, scheduled for July 2024, the 32.5 per cent threshold is increased to include those earning up to $200,000. This stage remains unchanged.

Who gets the most?

Australians earning $120,000 score $2,745, or around 8 per cent of their previous tax liability. That means that a family with two people earning this amount would save $5,490.

At the other end of the spectrum, those earning $40,000 will get back $1,060. While this is less than half of the benefit delivered to those earning $120,000, it reflects a bigger change in the percentage of tax paid, with this group paying 21.4 per cent less.

When will I get it?

The Australian Tax Office (ATO) will begin adjusting its brackets once the Budget is passed or the Opposition confirms its support. Then, your employers’ payroll office will begin setting aside that new level of tax.

“That’s something people will notice immediately because there’ll be more money in their hands,” HLB Mann Judd tax partner Peter Bembrick told Yahoo Finance.

This is expected to come into place by Christmas.

The more tricky question is how the ATO will deal with backdating the tax already paid.

Bembrick said there are a few ways this could go. The ATO could adjust its tax brackets gradually to account for tax previously paid. Or it could be a case that workers claim more tax back in the next financial year.

“It’s fairly unprecedented,” he said. “I can’t recall this being done.”

Why some will have to wait

However, some Australians will need to wait until July 2021 for $1,080 of their tax cut.

Australians earning less than $90,000 will see an overall $1,080 less paid in tax from their pay over the coming months but will need to wait until the end of the financial year for the second $1,080.

This is because the low- and middle-income tax offset is only paid as a lump sum at the end of the financial year. As those earning above $90,000 were never eligible for the offset, they will immediately see the full benefit.

For more Yahoo Finance stories on the 2020 Federal Budget, visit here.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.